In addition to the standard method of payment, the system recognizes a number of special methods of payment that can be defined per location. These alternative methods of payment are defined in the system using a code. These special codes are also used for a variety of price reductions and, if desired, for cancellation of amounts due. Once these methods of payment codes have been defined using AFO 494, they can be used in AFO 431, AFO 414 and AFO 417 to identify payments, discounts, cancellations et cetera.

When you select this menu option, an input screen will be displayed. If codes have already been defined, an overview screen will be displayed:

: Select a code and then this option to update the details for the relevant code.

: Select a code and then this option to delete the cash code.

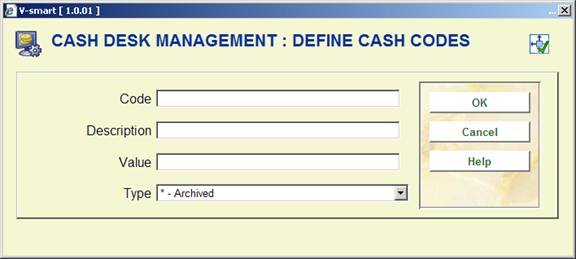

: Select this option to enter a new cash code. The following input form will be displayed:

Code: Enter the code for the method of payment. The code may consist of a maximum of three letters.

Description: Enter a description consisting of a maximum of thirty characters. The descriptions are displayed in the AFO where the code can be used and are also shown on the cash register overviews.

Value: Enter the value for the method of payment. Enter a “*” as code for cancellation of amounts due.

Type: Each code is used for a certain type. The type indicates the AFO(s) in which the code can be used, whether it represents a reduction, cancellation of an amount due or a method of payment, and whether a note must be entered when the code is used. You may choose from:

|

Type |

Description |

|

11 |

cancellation of amount due in the borrower administration (AFO 431) |

|

12 |

cancellation of amount due in the borrower administration (AFO 431) |

|

21 |

relative price reduction (percentage) in the borrower administration (AFO 431) |

|

22 |

relative price reduction (percentage) in the borrower administration (AFO 431) |

|

31 |

absolute price reduction (absolute amount) in the borrower administration (AFO 431) |

|

32 |

absolute price reduction (absolute amount) in the borrower administration (AFO 431) |

|

41 |

method of payment in the borrower administration (AFO 431) |

|

42 |

method of payment in the borrower administration (AFO 431) |

|

51 |

method of payment in registration of cash receipts (AFO 414) (without note) |

|

61 |

receipt category for free receipts (AFO 417) |

|

62 |

receipt category for free receipts (AFO 417) |

|

71 |

payment category for free (refund) payments (AFO 417) |

|

72 |

payment category for free (refund) payments (AFO 417) |

|

81 |

membership type 431 (this option is not yet in use) |

|

91 |

payments 414 (this option is not yet in use) |

|

101 |

waive reason (please note these cannot yet be used in AFO 414, but can be assigned in AFO 481 – Invoicing configuration) |

|

111 |

refund payment codes (these can be used in AFO 417) |

A few examples:

|

Type |

Meaning |

AFO |

Example |

|

11/12 |

Cancellation |

431 |

Borrower can show membership card of a different library |

|

21/22 |

Relative reduction |

431 |

Borrower is given 25% reduction on membership fee in second calendar quarter, 50% in third quarter and 75% in fourth quarter |

|

31/32 |

Absolute reduction |

431 |

Cultural passport |

|

41/42 |

Method of payment |

431 |

Gift certificate memberships |

|

51 |

Method of payment |

414 |

Strips for payment of loan charge |

|

61/62 |

Receipt category |

417 |

Receipts outside of the system |

|

71/72 |

Payment category |

417 |

Payments made from cash register (small, urgent expenditures on behalf of the library) |

Please note!

If a type ends with a “1”, entry of a note when using the code is not mandatory; if the type ends with a “2”, a note must be entered.

If a certain code is no longer in use but you want to save it in this table (for example because it must still be shown on the cash register overviews), the code should be assigned the type “*” (star). This means that the code is to be saved in the archives.

For the sake of clarity, a short explanation of the type is displayed with each code. The codes by which entry in the note field is mandatory are followed by “n!” in the Mandatory note column.

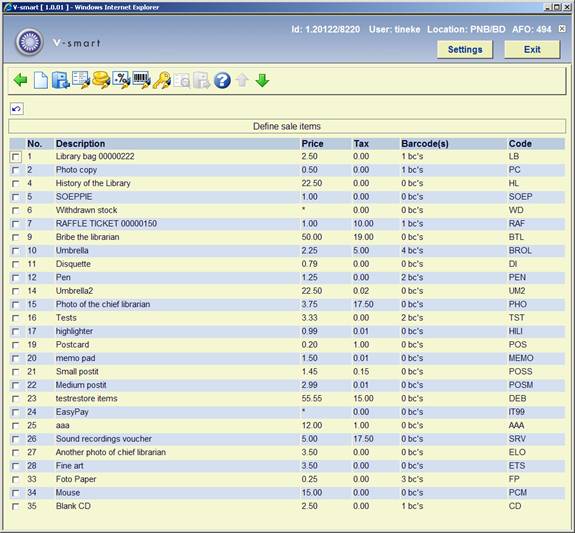

Per location, items that are sold in the library can be defined. The following can be indicated for each item: the article code, the description, the price, the tax percentage, et cetera.

The system distinguishes between the ‘active' list of articles (the articles that can be sold) and the 'historical' articles in the archives (all articles that have been included on the current list at some time). All control options are performed on the current list. Within the archives option, only detailed information concerning the sale of articles can be viewed. Sale items can be identified by article number, article code or barcode associated with the code.

When you select this menu option, an input screen will be displayed. If codes have already been defined, an overview screen will be displayed:

: Select this option to enter a new article code.

: Select an article and then this option to place the article in the archives. The system will ask whether or not the article is to be removed from the current list. If this is the case, the article can no longer be sold. It can still be viewed through the menu option “Active and historical sale items”.

: Select a code and then this option to update the details for the relevant code.

: Select an article and then this option to modify the article price

: Select an article and then this option to modify the tax percentage for the article

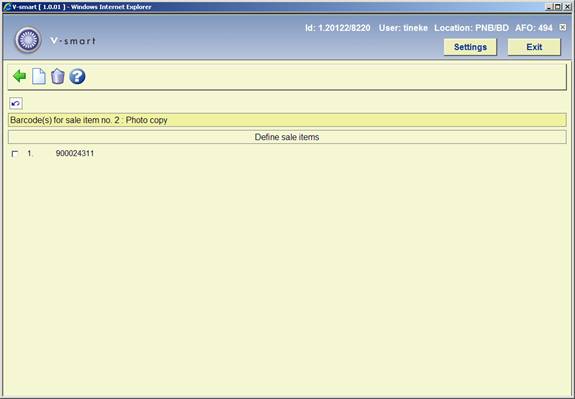

: Select an article and then this option to assign barcodes to the article. This option is explained in more detail in section 494.4.1.

: Select an article and then this option to modify the article code

: this option is not in use on this screen

: this option is not in use on this screen

Note

The SIP Server supports the Xafax request/response 43/44. This is an option to register services outside Vubis Smart for which payment is required. The following services are available:

· - use of a printer (!PRN)

· - use of a copier (!COP)

· - use of a PC, for instance for Internet access (!PCI)

· - "I owe you", i.e. borrower has received a fee to be paid back later (!IOU)

· - "refund", almost identical to "I owe you" (!REM)

· - use of a locker (!BOX)

· - unknown service but to be paid anyway (!UNK)

The possible services are to be registered in the borrower record as a specific (as yet unpaid) article sale, so called "system articles". The first time a request is received with such an option, this article is automatically defined in the system “Sale items” tables. To prevent unwanted deleting of such an article, the internal code has an ! as first character. The system prevents deleting articles with an ! as first character of the code.

By using barcodes, a sheet can be used at the circulation desk with the barcodes and a description of the articles. An article can then be identified simply by scanning the correct barcode. See AFO 416 (‘Sale items') for additional information. These barcodes can also be used in AFO 411 during loans.

When you select the option ‘Barcodes' after selecting an article, an overview screen will be displayed in which the barcodes that have been assigned to the selected article are listed.

: Select this option to enter a new barcode.

: Select a barcode and then this option to delete the barcode.

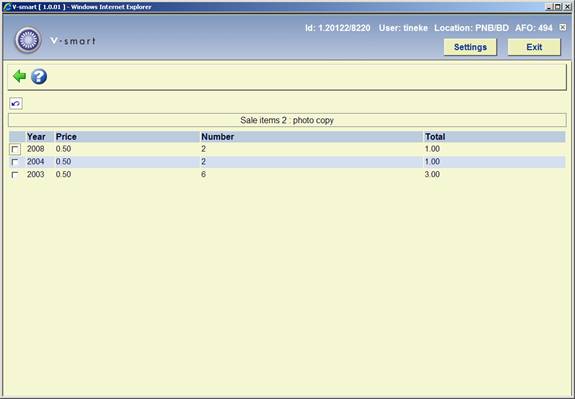

When this menu option is selected, an overview will be displayed of all articles that have ever been defined in the system, including those that are included on the current list.

The overview of articles in the archives is the same as that of the current list. There are only two of the options available though (which are inactive on the current list):

: Select an article number and then this option to transfer an article back to the current list. The number in this field therefore refers to an article number within the articles in the archives. This article number may not be listed in the current list, because then there would be no point in retrieving it.

: Select an article and then this option to view details concerning sales of the selected article. Then an overview screen will be displayed:

This screen indicates per calendar year the unit prices for the article, how many of the articles have been sold and the total sales price.

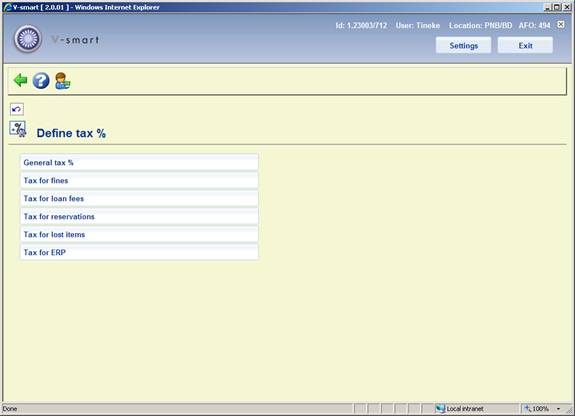

When showing cash register overviews, the system can also indicate tax percentages and amounts. AFO 494 can be used to define the various tax percentages.

When you select this menu option, a sub menu will be displayed.

When you select this menu option, an input screen will be displayed in which the tax percentage must be entered for each receipt type (subscription, sale, et cetera). See the help of AFO 492 for an explanation of the meaning of the various receipt types. The value defined for “Sales” is overruled by the percentage entered in article control.

When you select this menu option, an input screen will be displayed in which the tax percentage must be entered for each item category.

When you select this menu option, an input screen will be displayed in which the tax percentage must be entered for each item category.

When you select this menu option, an input screen will be displayed in which the tax percentage must be entered for each item category.

When you select this menu option, an input screen will be displayed in which the tax percentage must be entered for each item category.

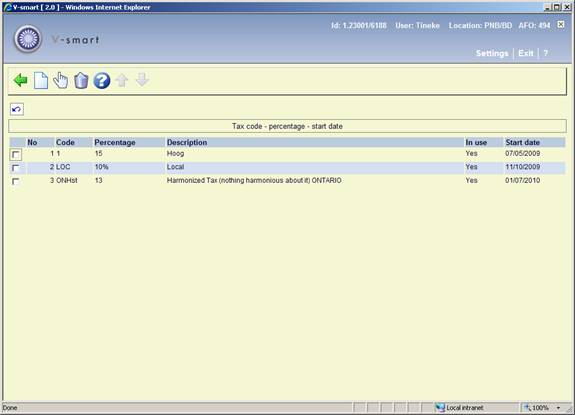

This option is related to the ERP export for AFAS (a feature designed initially for the Dutch market). After selecting this option a summary screen will be displayed:

: Select a code and then this option to update the details for the relevant code.

: Select a code and then this option to delete the tax code.

: Select this option to enter a new tax code. After choosing this option an input form will be displayed:

In use: To mark whether the code is in use or not.

Description: A brief description of the code.

Tax code: The unique code. These codes can be assigned via AFO 494 – Cash desk list descriptions.

Tax percentage: The percentage to go with this code.

Start date: The date from which this code is effective.

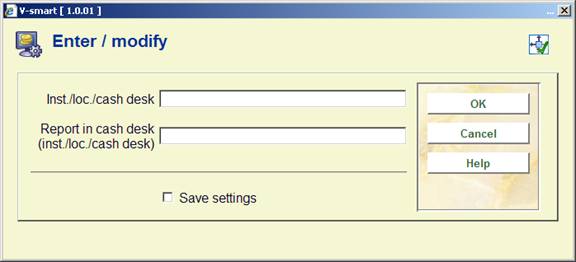

When you select this menu option, an input screen will be displayed. If cash register groups have already been defined, an overview screen will be displayed.

: Select a code and then this option to update the description for the relevant code.

: Select a code and then this option to delete the group code.

: Select this option to enter a new group code. After choosing this option an input form will be displayed:

Inst/loc./cash reg: Enter in the order indicated an institution code, a location code and a cash register code. Separate the codes using a "/" (slash).

Report in cash register (inst./loc./cash reg): Enter in the order indicated an institution code, a location code and a cash register code. Separate the codes using a "/" (slash). The receipts registered in the cash register that was entered in the first field, will be reported in the cash register overviews as receipts in the cash register defined in this field. I.e. these can be identical, but don't have to be.

When compiling the cash register lists, the system uses standard descriptions. If you so desire, these standard descriptions can be overruled and replaced by your own descriptions. These descriptions pertain to the types of receipts, sometimes combined with the types of material, borrower categories, et cetera. A typical use, for example, is to add accounting codes to the descriptions. When the system finds certain items in the table of explanations while compiling the cash register lists, the specific description will be used; if the item is not found in the table, the standard description will be used.

Please note!

This mechanism can only be used for overviews of the type ‘receipt/item category' (AFO 492).

The codes in the table differ slightly from the codes used elsewhere. The system distinguishes between the codes as displayed on the screen and the ‘internal' codes. When defining this table, the internal codes are used. In the table below, the internal code, its meaning and the code as described on the screen are shown.

|

Internal code |

English Code |

Description |

|

A |

M |

Membership fee |

|

B |

F |

Fine |

|

C |

C |

Catalog printouts |

|

D |

N |

Duplicate membership cards |

|

E |

O |

Create or increase deposit |

|

F |

B |

Refund from deposit |

|

I |

E |

Enrolment fee |

|

K |

S |

Sale items |

|

L |

L |

Loan fee |

|

M |

A |

Administrative fee |

|

P |

P |

Postage fee |

|

Q |

W |

WebOpac reservations |

|

S |

R |

Reservation |

|

V |

I |

Item fees |

|

W |

D |

Security payments |

|

X |

X |

Miscellaneous fees |

|

Y |

Y |

Services |

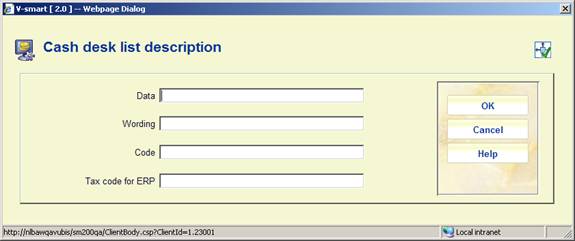

When you select this menu option, an input screen will be displayed. If descriptions have already been defined, an overview screen will be displayed:

: Select a code and then this option to update the description for the relevant code.

: Select a code and then this option to delete the list code.

: Select this option to enter a new list code. After choosing this option an input form will be displayed:

Data: Enter a piece of data. Two types of data can be entered in this field:

· a receipt type, by which the internal code must be used;

· a combination of a receipt type and a category indicating a sub-division within this type.

These categories are as follows:

|

Internal code |

Description |

Sub-division |

Example |

|

A |

Membership fee |

a borrower category |

A/T64 |

|

L |

Loan fee |

an item category |

L/C1 |

|

B |

Fine |

an item category |

B/C1 |

|

S |

Reservation |

an item category |

S/C1 |

|

K |

Sale articles |

an article number |

K/55 |

|

P |

Postage fee |

an item category |

P/C1 |

|

M |

Administrative fee |

a borrower category |

M/T64 |

|

W |

Security payments |

a borrower category |

W/T64 |

|

C |

Catalog printouts |

a borrower category |

C/T64 |

|

V |

Item fees |

an item category |

V/C1 |

|

I |

Enrolment fee |

a borrower category |

I/T64 |

|

D |

Duplicate membership cards |

a borrower category |

D/T64 |

|

Q |

WebOpac reservations |

a borrower category |

Q/T64 |

|

X |

Miscellaneous |

a payment method code |

X/CJP |

Wording: Enter how the information is to be described on the cash register lists.

Code: Enter a code corresponding for instance with your financial system.

Tax code for ERP: Use this to optionally link to a tax code as defined in AFO 494 – Define tax % – Tax for ERP.

Example for membership fee:

Data: A, Wording: [no.]Membership fee Code: [no.]. The two numbers must be identical. In that case membership fees will NOT be split on borrower category but just grouped under a single heading 'Membership fee'. E.g.:

[no.] Membership fee

Borrower category 1 amount

Borrower category 2 amount

Borrower category 3 amount

Example for fines per item category:

Data: B, Wording: [no.]Fines Code: [no.]. The two numbers must be identical.

Data: B/item cat 1, Wording : [no.]item cat 1 Code: [no.]. The two numbers must be identical.

Data: B/item cat 2, Wording: [no.]item cat 2 Code: [no.]. The two numbers must be identical.

In this case fine amounts will be grouped by item category. E.g.:

[no.] Fines

Item category 1 amount

Item category 2 amount

Item category 3 amount

Please note that for these examples to work, "[no.]" (number) must also be defined as part of the wording in Cash desk code descriptions.

When compiling past due invoices, the system can automatically calculate the price of items. This is done based on the price entered in the “copy information” field for an item. If so desired, the price can be automatically recalculated based on a table with item costs, by which it can be indicated (per year) what percentage of the original acquisition prices is to be charged.

Note

Year in this case is every calendar year that has elapsed since the item was entered on the system.

Bear in mind that the table defined in AFO 494 is used as a table with defaults; in other words, when compiling an invoice you can always overrule the amounts calculated by the system by entering the desired amount.

When you select this menu option, an input screen will be displayed. If information has already been defined, an overview screen will be displayed:

: Select a code and then this option to update the description for the relevant code.

: Select a code and then this option to delete the list code.

: Select this option to enter a new code. After choosing this option an input form will be displayed:

Material type: Enter the code for the material type. You may use one of the following formats:

· material type;

· the material type followed by a comma and the agency code; the amount is then only applied to items that belong to the relevant agency;

· the material type followed by a comma and the agency code/location code; the amount is then only applied to items that belong to the relevant agency/location.

Default price, % change per year: Enter the amount and/or percentage that must be applied in either of the following formats:

· the amount to be applied as the default ‘replacement fee' (if there is no price entered for an individual item, the system will use the amount defined in AFO 494 as the default value);

· an amount followed by an indication – if applicable per year – of the amount to be deducted based on the age of the item; in this, either an absolute amount or a percentage can be defined.

Examples:

- default amount = 5, then percentage increase of 5% each year entered as

· 5->105%->110%->115%->120%

When an item is entered in 2003 without price information, the replacement value in 2006 (3 years later) will be 5.75 (115% of 5).

- Absolute amounts can be added too:

· 25->30->35->40 etc

The system can sort cash desk lists based on what are known as cash register codes. This makes it possible to customize the overviews. This working method is also applied when generating the cash desk lists (using AFO 496).

When cash desk overviews are sorted using these codes, a description can also be printed for each code. Using the table in AFO 494, you can define the description to be used for the cash desk codes.

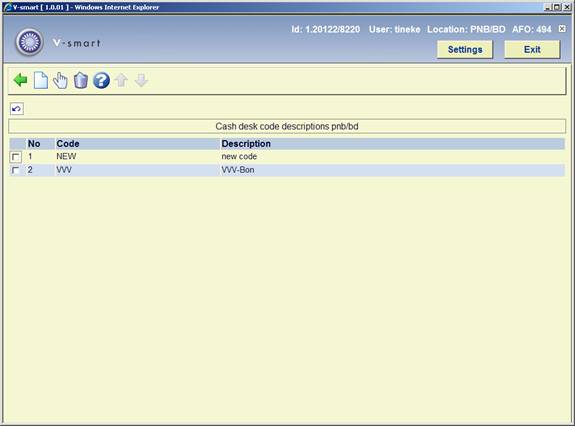

When you select this menu option, an input screen will be displayed. If cash desk codes have already been defined, an overview screen will be displayed:

: Select this option to enter a new code.

: Select a code and then this option to update the description for the relevant code.

: Select a code and then this option to delete the code.

The system can generate what are known as cash desk lists. Journals give an overview of the financial situation for a specific location. For the period that you specify, a journal will give you a survey of the incoming and outgoing cash flows in that location.

In order to make it possible to generate these lists, the system allows the definition of one or more ‘profiles'. These profiles are used to generate the cash desk lists within a certain framework; a number of characteristics can be assigned to each profile. These characteristics help determine the contents and appearance of the journal.

When you select this menu option, an input screen will be displayed. If profiles have already been defined, an overview screen will be displayed:

: Select a code and then this option to update the description for the relevant code.

: Select a code and then this option to delete the code.

: Select this option to enter a new code. After choosing this option an input form will be displayed:

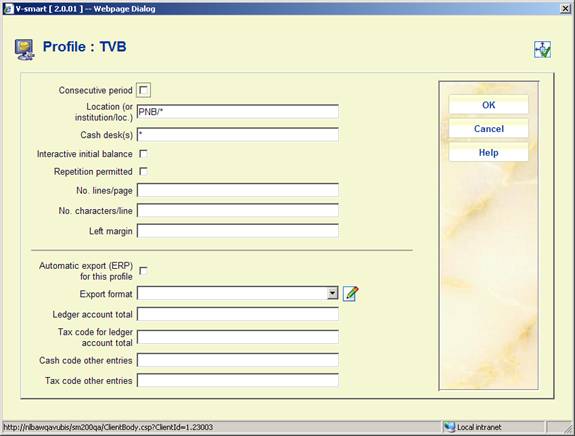

Give the profile a name and click . Now select this profile from the list. A new input form will be displayed:

Consecutive period: Indicate whether or not the period is to be consecutive.

Location (or Intitution/Location): Enter the institution and/or location code(s) in this field.

Cash deks(s): Enter the code of the cash desk(s) to which the cash register list applies. Enter a “*” (star) if you want to include all cash desks.

Interactive initial balance: Indicate whether or not the opening balance is interactive; this determines whether or not the opening balance may be modified. If this is not the case, the system will apply the balance from the previous journal.

Repetition permitted: Indicate whether or not repeats are allowed. This means that the cash register list may be generated more than once.

Number lines/page: Enter the number of lines to be printed on each page.

Number of characters/line: Enter the number of characters to be printed on each line.

Left margin: Enter the number of characters to be used for the margin on the left.

Automatic export (ERP) for this profile: check this option if the profile must be used for automatic ecporting for ERP.

Export format: This field is reserved for future use.

This section allows for various settings related to miscellaneous payments and refunds in AFO 417.

After selecting this option, an input form will be displayed:

Allow input of reference no: When this option is checked, the form for miscellaneous payments in AFO 417 will display an additional field where an invoice or rerefence number can be entered.

Valid miscellaneous payment types: If payment types have been defined in AFO 494 – Cash codes, they will appear here for selection. Valid payment types may be moved to the right hand side. If nothing is defined, then "cash" is assumed. The types selected here will appear in the dropdown list of the form for miscellaneous payments in AFO 417.

Valid refund payment types: If refund payment types have been defined in AFO 494 – Cash codes, they will appear here for selection, in addition to the default of "cash". Valid payment types may be moved to the right hand side. The types selected here will appear in the dropdown list of the form for miscellaneous refunds in AFO 417.

Allow credit/debit card payment for memberships: When this option is checked, it is possible to use electronic payment for membership fees. Otherwise, when electronic payment is available, this can be used to pay every type of charge except membership fees.

· Document control - Change History

|

Version |

Date |

Change description |

Author |

|

1.0 |

June 2008 |

creation |

|

|

2.0 |

November 2009 |

textual improvements; new cash codes; new menu option for misc payments and refunds; additions for ERP export |

|

|

3.0 |

April 2010 |

New screen layout cash desk list descriptions; tax % |

|